A recent Texas Lawbook article, “Exclusive: Legal & Financial Advisers Feast on Bankruptcy Fees from the Oil Patch,” reports that, when times were good in the oil patch and crude was selling at a $100 a barrel just three years ago, lawyers and bankers scored record profits advising companies on a record number of mergers, acquisitions, joint ventures and securities offerings.

A recent Texas Lawbook article, “Exclusive: Legal & Financial Advisers Feast on Bankruptcy Fees from the Oil Patch,” reports that, when times were good in the oil patch and crude was selling at a $100 a barrel just three years ago, lawyers and bankers scored record profits advising companies on a record number of mergers, acquisitions, joint ventures and securities offerings.

For the past two-and-half years, the energy industry has been in crisis. Oil slipped to $30 a barrel. Thousands and thousands of people lost their jobs. A record number of oil and gas companies and the businesses servicing them declared bankruptcy.

The law firms and financial counselors working for those distressed energy operations, however, continue to pocket hundreds of millions of dollars thanks to the complex federal bankruptcy system.

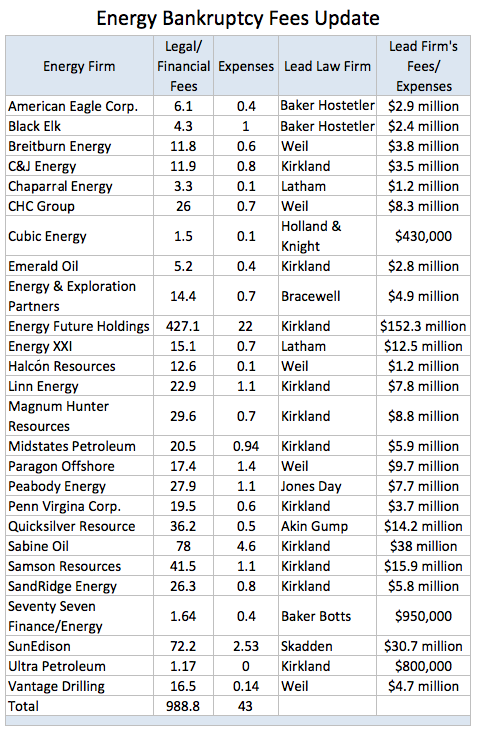

The energy companies that declared bankruptcy during the past 30 months – a majority of them based in Texas – have paid their legal and financial advisers – nearly all of them based in New York and Chicago – more than $1.4 billion in fees and expenses during the past two and one half years, according to a Texas Lawbook examination of court records.

Those same lawyers and consultants have requested another $260 million in payments that are pending the approval of federal bankruptcy judges in Texas, Delaware, New York and Oklahoma. In addition, there are more than 60 active bankruptcy cases in which the legal and financial advisers have not yet filed their fee requests for the fourth quarter of 2016 – fees that experts conservatively estimate will add another $80 million to the final tab.

Since July 2014, three law firms – Kirkland & Ellis, Weil, Gotshal & Manges and Skadden Arps – have been paid a combined $354 million for their representation of distressed energy companies during the past two and a half years, which does not include pending requests for payment or yet-to-be filed invoices for expected for work already completed.

“The business of corporate bankruptcy has become very lucrative for a small group of professionals,” Gary Kennedy, the former American Airlines general counsel who guided the Fort Worth company through Chapter 11 two years ago, said at a seminar at SMU Dedman School of Law last year. “It has gotten so expensive that some companies can no longer afford to go bankrupt.”

Before the current oil and gas crisis, bankruptcy law practice had been in the toilet for years because many larger businesses chose to avoid bankruptcy court by using the shadow banking system of private equity firms and hedge funds to re-balance their financials. Companies that did seek bankruptcy protection tended to file in Delaware or New York instead of Texas. As a result, Texas law firms either fired lawyers who specialized in restructurings or had them focus on other practice areas.

All that changed in the second half of 2014 when the price of petroleum sank. More than 1,280 Texas businesses have filed for bankruptcy during the past two years – many of them related to the downturn in oil and gas prices, according to new data research provided by Androvett Legal Media. “Most bankruptcy law practices were pretty slow, but now most bankruptcy lawyers are either busy or crazy busy,” says Vinson & Elkins partner Bill Wallander, who leads the firm’s reorganization and restructuring practice.

“Energy has been the dominant theme – lots of upstream, some midstream and some oil and gas services companies filing for bankruptcy,” Wallander says. The Androvett data shows that 752 businesses filed for bankruptcy restructuring in Texas federal courts in 2016 – up 42 percent from 2015 and up 80 percent from 2014. The data demonstrate a clear connection between bankruptcy activity in Texas and the financial health in the oil patch.

New business bankruptcies filed in the Western District of Texas increased by 100 percent during the past two years – from 73 in 2014 to 146 in 2016, according to the Androvett study. The jump was even bigger in the Southern District, where 293 companies filed for Chapter 11 bankruptcy protection in 2016 – up from 141 in 2014.

The Northern District witnessed a 49 percent escalation in corporate bankruptcies from 2014 to 2016. Business restructurings in the Eastern District climbed 75 percent during the past two years. More than 150 oil and gas companies filed for bankruptcy in 2016 – 71 of them were exploration and production operations with a cumulative debt of $56.8 billion, according to Haynes and Boone’s Oil and Gas Bankruptcy Monitor (pdf).

The Haynes and Boone data shows that 70 oil and gas services companies and a dozen midstream firms also filed for Chapter 11 protection last year. “We are not seeing the wave of E&P bankruptcies that we witnessed earlier, but there is still a lot of distress out there, and there’s still a lot of first lien debt that is non-performing,” says Thompson & Knight partner Tye Hancock, who specializes in oil and gas bankruptcy. “A lot of it depends on where the assets are located,” Hancock says. “The cost of performing in North Dakota is a lot more than in the Permian Basin.”

When Houston-based Stone Energy sought Chapter 11 protection on Dec. 14, it was the 114th E&P company to declare bankruptcy. The total debt of those companies, according to Haynes and Boone, was $74.2 billion. More than 110 oil and gas service companies with a cumulative debt of $18.8 billion have filed. The 16 midstream firms that are in bankruptcy have a combined debt of $17.2 billion.

This article was posted with permission. For a full version of this article, visit www.texaslawbook.com.